The Benefits of a Cyprus Limited: Why Starting a Company in Cyprus Pays Off

If you're a business owner, freelancer, or day trader, you probably know the feeling: high taxes eating into your income, endless social contributions, and complex compliance rules that slow you down. It's frustrating, and it often feels like your home country is holding you back from growing your business and achieving the financial freedom you've worked so hard for.

That's why more and more entrepreneurs are seeking better tax solutions and business-friendly jurisdictions, and Cyprus consistently stands out.

This Mediterranean island has quietly become one of Europe's most attractive destinations for company incorporation. A Cyprus Limited Company offers clear tax benefits: a 15% corporate tax rate (one of the lowest in the EU), 0% dividend withholding tax, and personal tax advantages under the Non-Dom program. On top of that, you get full EU market access, the euro as currency, and a simple, English-speaking legal system rooted in UK common law.

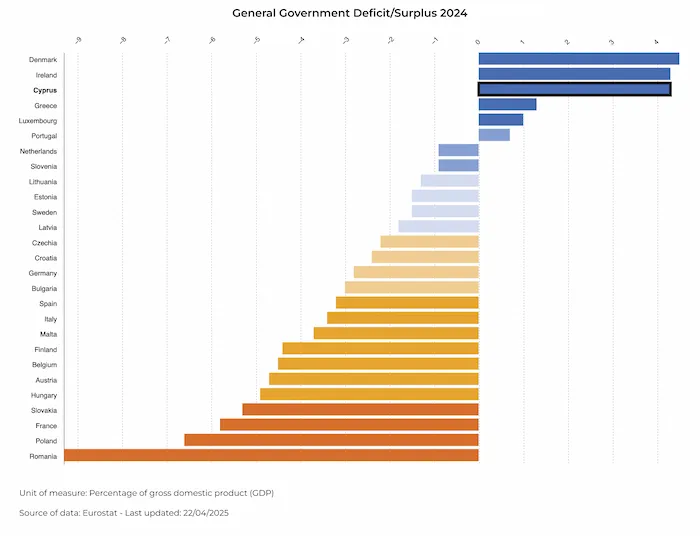

But here's the interesting part: According to Eurostat, Cyprus recorded a 4.3% budget surplus in 2024, one of the strongest performances in the EU. While many countries pile on debt and invent new taxes, Cyprus is doing the opposite.

It operates toll-free highways, offers high-speed fiber internet, remains one of the safest places in Europe, and has established a business environment that enables entrepreneurs to thrive.

4 Key Benefits to Pick a Cyprus Limited Liability Company

- Low Corporate Tax (15%): One of the lowest rates in the EU, supported by an extensive network of double-tax treaties.

- Cross-Border Friendly: Dividend payments to shareholders are free from withholding tax, making Cyprus an ideal location for global business structures.

- Non-Dom Program: Personal tax advantages for new residents (i.e., founders), including 0% tax on dividends and interest for 17 years.

- Easy Setup & Compliance: Quick company registration, clear upfront costs, and lower ongoing expenses than in many other EU jurisdictions.

These four benefits together make Cyprus an outstanding choice for freelancers, digital entrepreneurs, e-commerce founders, investors, and HNWIs. But the real difference lies in the Non-Dom Program. It's the key that transforms a Cyprus Limited Company from a tax-efficient structure into a genuine rocket booster for personal wealth generation, mobility, and financial freedom.

In the following sections, we'll explore how setting up a company in Cyprus, combined with Non-Dom status, can open doors to opportunities that business owners in high-tax countries usually only dream about.

Table of Content:

- What is a Cyprus Limited Liability Company?

- Cyprus Tax Benefits for Companies & Founders

- How Cyprus Treats Companies dealing with Crypto & Modern Assets

- Who Benefits the Most from a Cyprus Limited Company?

- How to Set Up a Cyprus Limited Company: Step by Step

- Legal Obligations of a Cyprus Limited

- How Much Does It Cost to Set Up a Cyprus Limited Company?

- FAQ: Cyprus Limited Company

- Why Register your Cyprus Company with Cypruslimited.com?

What Exactly Is a Cyprus Limited Liability Company?

When people talk about "setting up a Cyprus Limited," they usually mean creating a Cyprus Limited Liability Company (Ltd). Built on the UK common law system, a Cyprus Ltd follows international standards that are recognized by entrepreneurs, investors, and banks worldwide. That makes it both reliable and easy to work with.

At its core, a Cyprus Limited is a separate legal entity. In practice, that means the company, not you personally, can enter into contracts, own property, open bank accounts, and carry its own liabilities. For founders, this adds a valuable layer of asset protection, ensuring your personal wealth stays separate from your business risks.

Key Features of a Cyprus Limited Liability Company

- Ownership: Can be formed by just one shareholder (an individual or another company). 100% foreign ownership is fully allowed.

- Directors: Only one director is required. To qualify as a Cyprus tax-resident company, management and control should be in Cyprus, often achieved by appointing a Cyprus-based director.

- Secretary: Every Cyprus Limited must appoint a company secretary, who is responsible for maintaining statutory records and ensuring filings with the Registrar. The secretary can be an individual (usually one of the shareholders) or a corporate service provider. If the director is also the only shareholder, they can also appoint themselves as the secretary.

- Capital: No minimum share capital requirement (though €1,000 is commonly used for practical reasons).

- Liability: Limited to the company's own assets. Shareholders are only liable up to the amount they invest.

- Business Scope: Can be used for almost any activity: e-commerce, consulting, trading, investment holding, fintech, crypto, and more.

- International Reputation: As an EU member state, Cyprus offers full credibility and global recognition, unlike many "offshore" jurisdictions that often face restrictions, money transfer, or reputation issues.

Why a Cyprus Stands Out from Other Jurisdictions

Not all "low-tax" setups are created equal. Many so-called tax havens outside the EU raise red flags with banks, payment providers, and business partners. Cyprus is different.

- EU Status: A Cyprus Limited is a fully fledged EU company, subject to EU laws and regulations. This gives you credibility and makes it far easier to open bank accounts, work with payment providers, and build trust with partners worldwide.

- Tax Benefits: With a corporate tax rate of just 15% plus double taxation treaties with over 60 countries, Cyprus combines tax efficiency with global recognition. In the next section, we’ll explain the tax benefits in more depth.

- Simplicity: Registration is fast (usually 7-10 working days), and ongoing compliance costs are much lower than in most other EU jurisdictions.

- Transparency: Annual audits and financial reporting are required. Far from being a burden, this transparency strengthens your reputation when doing business internationally.

A Cyprus Limited Company is a flexible, respected business structure that works for freelancers, digital entrepreneurs, e-commerce founders, and global investors alike. This setup offers freedom and growth potential without the stigma or invoicing or payment headaches associated with offshore setups.

Cyprus Tax Benefits for Companies & Founders

For freelancers, entrepreneurs, and investors, taxes are often the biggest roadblock. You take the financial risks, put your reputation on the line, and work hard to grow. Yet your government usually takes the lion's share through high income taxes, endless social contributions, and layers of bureaucracy. Instead of appreciation, you're treated like a piñata. 🪅

Cyprus changes that. Here, you'll find one of the most business-friendly tax systems in the EU. That means you keep credibility and full banking access (you are not tied to use a Cyprus bank), while dramatically reducing your tax burden. Best of all, the benefits apply on two levels: your company profits and your personal income as a founder if you choose to relocate.

Corporate Tax Layer (Cyprus Ltd)

- Headline rate: 15% corporate income tax

- Big wins: 0% withholding tax on outbound dividends, plus 60+ double-tax treaties for smoother cross-border structuring.

- Extra perks: No capital gains tax on securities (shares and ETFs), 8% tax on crypto, an attractive IP box regime (3% effective tax rate), and no wealth or inheritance tax.

If you're building an international structure, whether it's a global e-commerce store, a SaaS company, a consulting or trading business, or simply an investment vehicle, a Cyprus Company gives you the freedom to expand without borders. Profits face just 15% corporate tax, and because there's no withholding tax on dividends, you can reinvest, pay yourself, or move funds across jurisdictions with far less friction than in high-tax countries like Germany or France.

We've prepared a detailed guide on corporate taxation in Cyprus that breaks down the different tax rules. It's worth reading if you want to get a deep dive.

Suppose you set up a Cyprus company but continue to manage it from your home country, particularly if that country has a high tax rate. In that case, you risk creating a so-called permanent establishment there. Tax authorities may argue that your real place of management is still at home, which could trigger audits, disputes, and even double taxation.

The safe way to avoid this risk is to make your company genuinely tax resident in Cyprus. That means management and control, like board meetings, strategic decisions, and a Cyprus-based director, should take place here. It's not just a legal formality; it's what protects your structure and gives your company international credibility.

And here's the huge benefit: if you, as the founder, also relocate and become a Cyprus Non-Dom tax resident, you not only eliminate these substance risks once and for all, but you also unlock the rocket booster for your personal finances:

Personal Tax Layer (Founder relocating as Non‑Dom)

- Headline benefit: 0% tax on dividends & interest for 17 years (Non‑Dom rules)

- Plus: Salary incentives for new residents (commonly up to 50% salary exemption)

Saving tax at the company level is powerful, but what matters is how much you can keep in your pocket as the founder. This is where Cyprus stands out in Europe with its Non-Domicile (Non-Dom) Program.

How the Non-Dom Program Works

Suppose you relocate to Cyprus, register as a tax resident, and qualify for Non-Dom status. In that case, you gain 17 years of 0% personal tax on dividend and interest income. In other words, the profits your Cyprus Limited pays out to you as dividends are completely tax-free at the individual level.

I've written a comprehensive Cyprus Non-Domicile Guide where you'll find all the details: who qualifies, how to apply, and the exact numbers you need to know.

Add to that generous salary exemptions for new residents (up to 50% of employment income can be tax-exempt), and you have the flexibility to design an income structure that is both compliant and extremely efficient.

Relocation Watch-Outs You Should Know

- Exit Tax in High-Tax Countries: If you're leaving countries like Germany, strict exit tax rules may apply. These need to be carefully planned before you relocate.

- EU/EEA Citizens: Relocating within the EU/EEA is generally seamless. You can take advantage of the Non-Dom program without heavy immigration barriers.

- Non-EU Citizens: For non-EU founders, Cyprus requires proper visas and permits. To make this easy, we've built an Immigration Action Plan Builder that checks your eligibility and shows your visa options step by step.

Why Your Personal Tax Rate Matters

In most countries, withdrawing profits is where tax really bites: corporate tax may be tolerable, but personal income and dividend taxes often strip away half your earnings. The Non-Dom program changes the game. It allows you to build wealth over time instead of watching it vanish into bureaucracy and social contributions.

This is the rocket booster we mentioned earlier: corporate tax savings already put you ahead, but combining them with Non-Dom status is what makes Cyprus one of the most attractive places in Europe for entrepreneurs, traders, and investors who value freedom.

And by relocating, you also eliminate the substance and permanent establishment risks. No more uncertainty about where your business is really managed. Your company and your personal tax home are both firmly and securely in Cyprus. That gives you peace of mind, credibility, and a clean, compliant structure that banks, partners, and authorities can trust.

Tax Comparison: Cyprus vs Other (E)EU Countries

Rates refer to statutory headline rates for FY2025 (or latest), not effective rates. Treaty reliefs can reduce WHT.

| Country | Corporate Tax | Tax on Dividends (Individuals) |

|---|---|---|

| Cyprus | 15% | 5% (Domiciled) / 0% (Non-Domiciled) |

| Germany | ~29.9% (combined avg)* | 26.375% (25% + 5.5% solidarity on the tax) |

| Austria | 23% | 27.5% |

| France | 25% | 12.8% |

| Portugal | 20% | 25% |

| Norway (EEA) | 22% | 25% |

How Cyprus Treats Companies dealing with Crypto & Modern Assets

Crypto traders, fintech founders, and Web3 builders often face the same struggle: their home country either taxes them into the ground, treats crypto with suspicion, or makes banking nearly impossible. Some turn to offshore "havens", only to run into red flags with regulators, banks, and partners.

Cyprus offers a more innovative alternative. It's not a free-for-all "crypto haven," but an EU jurisdiction with low taxes, clear rules, and international credibility. That balance is precisely what modern entrepreneurs are looking for.

A Cyprus Company for Crypto & Fintech Businesses

- Tax on Trading Profits: Profits from crypto trading or investing through a Cyprus Limited are taxed at the rate of 8 % (Any losses from disposal may be offset against profits within the same year).

- Securities Exemption: Under Article 8(22) of the Cyprus Income Tax Law, profits from specific securities (shares, bonds, options, and fund units) are tax-exempt.

- No Tax on Unrealized Gains: Simply holding crypto that increases in value is not taxed until converted into fiat.

- Distributions: Profits can be paid out with 0% withholding tax to non-resident shareholders or Cyprus Non-Doms. Dividends paid to companies in very low-tax jurisdictions (below Cyprus's 15% rate) will be subject to a 5% withholding tax in Cyprus.

- Substance & Compliance: To enjoy treaty benefits and global recognition, the company should demonstrate management and control in Cyprus (local director, office, proper accounting).

For high-volume traders, crypto investment businesses, or Web3 startups, this setup offers a rare combination of predictable taxation, EU credibility, and banking access.

Beyond Trading: Building Modern Assets in Cyprus

Cyprus is not just attractive for traders. It's also a place where innovators and builders can structure and scale modern asset businesses. Whether you're developing blockchain software, launching a fintech app, or running a Web3 platform, Cyprus gives you a stable EU base with flexible tax incentives.

- IP & Web3 Projects: Cyprus offers an IP Box regime with up to 80% tax exemption on qualifying IP. While crypto tokens themselves don't qualify, blockchain platforms, fintech apps, and other digital IP often do.

- Regulatory Certainty: As part of the EU, Cypriot companies benefit from frameworks like MiCA (Markets in Crypto-Assets Regulation), giving exchanges, wallets, and fintechs a credible European base.

- Banking Access: With the right substance, opening an EU IBAN account is straightforward. However, it depends on your business model and the bank's risk appetite.

For crypto traders, fintech startups, and Web3 founders alike, Cyprus offers the best of both worlds: clear low taxation and a forward-looking environment for building modern digital businesses.

Who Benefits the Most from a Cyprus Limited Company?

You've worked hard for years and built visible success. Yet you still feel exhausted. High taxes and constant entrepreneurial risk drain your energy and motivation. Instead of sensing progress, it feels like the system keeps putting obstacles in your way. And the balance between risk and reward has long stopped making sense.

Many entrepreneurs I've met feel the same, and I know it from my own experience as well. At some point, the moment comes when we ask ourselves how to take our business and our life to the next level: less burden, more security, better opportunities. Successful entrepreneurs don't wait for circumstances to change. They search for a solution and take action!

Now picture a different reality: your business taxed at just 15%, with profits flowing to you personally at 0% under the Non-Dom program. Instead of chasing bureaucracy, you're building, investing, and enjoying the life you set out to create in the first place. Add in sunshine, safety, and EU credibility, and suddenly growth no longer comes with handcuffs.

That's what a Cyprus Limited Company can unlock. But who exactly benefits the most from this setup?

- Freelancers & Digital Nomads: Independent professionals serving global clients who want lower taxes and full EU credibility.

- E-Commerce Founders: Online shops and digital product businesses scaling across Europe and beyond.

- SaaS & IP-Based Companies: Software developers and digital platforms benefiting from the Cyprus IP Box regime.

- Consultants & Service Agencies: Marketing, design, or consulting firms working cross-border.

- Professional Investors & Traders: Stock, and asset traders seeking a predictable 15% tax framework. Flat tax on Crypto trading profits (8%) and no tax on unrealized gains.

- High-Net-Worth Individuals & Family Offices Wealth structures taking advantage of the Non-Dom program and 0% tax on dividends.

- Holding & Structure Companies: Groups bundling EU and non-EU subsidiaries under a clean, EU-based holding.

Next, let's examine why so many are already making the move:

Cyprus Limited Company Benefits by Persona

Select a persona to learn more:

Freelancers & Digital Nomads

Your office is your laptop, your clients are scattered across the globe, and the 9-to-5 was never for you. So, why let high-tax countries consume 30–49% of your income?

- Keep more of what you earn: Route your freelance income through a Cyprus Ltd and pay just 15% corporate tax.

- Get paid without borders: Clients trust an EU company far more than a personal PayPal or an offshore entity.

- Pay yourself a salary: Receive an income tax-free salary (up to 22.00 €) and benefit from a national health insurance, or get access to affordable, optional international health insurance plans (around 1.000€ per year as a Cyprus resident)

- Lifestyle synergy: It is enough to stay 60 days in Cyprus to become a Non-Dom tax resident, making it perfect for exploring the world while staying fully compliant.

For digital nomads, Cyprus isn't just a tax solution; it's where work and lifestyle finally align.

Nothing illustrates the difference more clearly than real numbers. Imagine running the same business, with the same clients and the same profits, yet ending the year with over 50% more net in your pocket simply by relocating to Cyprus. That's the kind of game-changing shift many entrepreneurs dream of .

Let's take a closer look at the story of Anna, a German founder who faced this very decision.

Case Study: A German Founder Moves to Cyprus

Anna, 34, SaaS founder (Germany → Cyprus). Illustrative persona.

“Relocating freed up about €78k per year . Extra cash to build a safety net, invest for retirement, and give me the flexibility to run my business on my terms.”

Option B: Relocate and register a Cyprus Limited

Profit before tax: €250,000

Corporate Tax

15% (Corporate Income Tax)

€37,500

Dividend Tax

0% (with Non-Domicle Status)

€0

NHS on Dividends

2.65% (cap €4,770/yr)

€4,770

- Total Taxes & NHS

- €42,270

- Effective Leakage

- ~16.9%

- Amount you keep

- €207,730

Assumes Non-Dom status applies; NHS cap enforced.

Assumptions & Notes

We ignore church tax (Germany), personal allowances, and any additional salary/social insurance planning. Trade tax in Germany varies by municipality; we used the national average, which is embedded in the ~29.9% combined rate. Calculations model a simple "distribute profits annually" scenario. Last update: January 2026.

Takeaway: For an owner-managed digital business, the difference in annual take-home is life-changing!

What if Anna wants a salary too?

Suppose Anna draws a qualifying salary as a Cyprus tax resident. In that case, the 50% income tax exemption for new residents earning €55,000+ can apply for up to 17 years, significantly lowering personal income tax on that salary while leaving dividends tax‑free under the Non‑Dom rules. (Exact outcome depends on salary level and benefits; use your Cyprus Tax Calculator and check the "New Tax-Resident" box to model.)

Below, I provide a brief overview of social security contributions, national health insurance contributions, and income tax rates. For a deeper understanding, I recommend reading our salary example of a managing director in Cyprus or checking the comprehensive explanations provided in our tax calculator results.

Social Contributions (2026)

| Contribution | Rate | Cap |

|---|---|---|

| Self-employed individuals | 16.6% | € 62,868 |

| Employee | 8.8% | € 62,868 |

| Employer | 8.8% | € 62,868 |

| Redundancy Fund (Employer) | 1.2% | € 62,868 |

| Human Resource Development Authority Fund (Employer) | 0.5% | € 62,868 |

| Social Cohesion Fund (Employer) | 2% | no cap |

| Contribution | Rate |

|---|---|

| Every self-employed on his emoluments | 4% |

| Every employee on his emoluments | 2.65% |

| Every employer on his employee’s emoluments | 2.90% |

| On the pension income of every pensioner | 2.65% |

| On earning income (e.g. rent, dividends, interest, etc) | 2.65% |

Individual Income Tax Brackets (After SI and NHS contributions)

| Tax Bracket | Rate |

|---|---|

| Up to € 22,000 per year | 0% |

| From € 22,001 to € 32,000 | 20% |

| From € 32,001 to € 42,000 | 25% |

| From € 42,001 to € 72,000 | 30% |

| Above € 72,000 | 35% |

Expert Insight

Digression: Tax Consequences of Emigrating from Germany

By Eduard Fütterer, tax consultant and former German tax official

If you're considering a move to Cyprus, keep in mind that not every country treats emigration the same way. Some tax offices barely pay attention when you leave, while others, like Germany, are far stricter. That's why German residents in particular should be aware of the pitfalls and read my article "Emigrating from Germany: What Tax Law Has to Say".

How to Set Up a Cyprus Limited Company: Step by Step

Starting a company in Cyprus is more straightforward than most people expect. With the proper guidance, the company registration is typically completed within 7–10 working days. Here's how it works in practice:

Choose & Reserve Your Company Name

The Cyprus Registrar must approve your company name. It can be in English or Greek and must end with 'Ltd.' or 'Limited'. This process can take a few days and must be repeated if the name is rejected (e.g., because it is already taken, too generic, or offensive).Draft the Memorandum & Articles of Association

These documents define your company's scope and internal rules. By law, they are prepared by a licensed lawyer in Cyprus. This step sets the legal foundation for your business.

Appoint Directors & Shareholders

At least one director and one shareholder are required (and they can be the same person). To qualify for Cyprus tax residency, management and control must be exercised in Cyprus, typically involving the appointment of at least one Cyprus-resident director.

File Incorporation with the Registrar

The signed incorporation documents are submitted to the Registrar of Companies. Once approved, you'll receive your official Certificate of Incorporation and Company Registration Number. This is the moment your Cyprus Limited comes to life.

Register for Tax & VAT

Every company needs a Tax Identification Number (TIN). VAT registration is required if your annual turnover exceeds €15,600, or if you provide services across the EU under VAT rules.

Open a Business Bank Account or Payment Solution

You can choose between local Cypriot banks, EU banks, or modern fintech providers. Because a Cyprus Limited is an EU-recognized entity, it is widely accepted by international payment processors and platforms.

Social Insurance Registration (if employing someone)

If your company plans to hire employees, it must apply for a Social Insurance Number. And suppose you, as the founder, want to be employed by your own company (for salary, work permit, or pension contributions). In that case, you will also need to register for social insurance personally.

Legal Obligations of a Cyprus Limited

Let's be clear: a Cyprus Limited Company isn't a "set and forget" structure. Like every EU company, it comes with compliance obligations. The difference? In Cyprus, these obligations are straightforward, affordable, and designed to protect your credibility with banks, partners, and tax authorities worldwide.

Annual Accounting & Audit

- Full audit required: Every Cyprus Limited must prepare audited financial statements, regardless of size.

- Accounting standards: Records must be kept up to date, in line with International Financial Reporting Standards (IFRS).

- Annual return: Submitted to the Registrar of Companies together with audited accounts.

- Filing deadlines: Audited accounts are due within 12 months after the end of the year; the company's return is filed annually.

While the word "audit" might sound heavy, in practice, Cyprus audits are much more affordable than in Germany, the UK, or Malta.

Typical Ongoing Costs

- Accounting & Audit fees: From €1,800/year with our Accounting & Audit Package (basic activity level). Larger businesses with more transactions may pay between €3,000 and €5,000.

- The Municipality Professional License Fee: A flat fee of €250, payable by all active companies. It is levied by the municipality in which the company is based.

- Tax filings: Corporate tax return, VAT returns (if registered), employer returns (if staff are employed). Covered by our Accounting & Audit package.

- Registered office: You need to rent an office, use your private address or a virtual office service like we offer our clients for €600/year.

On average, annual compliance costs in Cyprus are 30–50% lower than in other EU jurisdictions.

Substance & Management

For your company to qualify as a Cyprus tax resident, effective management and control must be in Cyprus. That typically means:

- At least one Cyprus-resident director.

- Board meetings held (or at least documented) in Cyprus.

- A registered office address in Cyprus.

For companies with international activity, substance isn't just a legal formality; it's your best safeguard against tax disputes abroad.

How Much Does It Cost to Set Up a Cyprus Limited Company?

One of the biggest worries when expanding abroad is hidden costs. Lawyers here, accountants there, overpriced application fees in between. That's why we keep things simple: no surprises, just fair and honest pricing.

With Cypruslimited.com, everything is bundled into a seamless, fully digital process on our platform, supported by a personally assigned accountant. You receive a comprehensive company formation package, with or without personal Immigration and Non-Dom status. The cherry on top is our modular accounting and audit package, which is more affordable than those of similar providers.

Our All-Inclusive Company Formation Packages

Cyprus Limited

- Everything needed to incorporate your Cyprus company

- Ongoing consultation, name approval, legal drafting, registration, certificates

- Corporate tax ID, VAT, Social Insurance number

- Support opening a bank account

Cyprus Limited + Non-Dom (EU citizens)

Everything in the Company Setup package, plus your personal applications and relocation support.

- Yellow Slip (residence), individual Tax ID, Social Insurance registration

- Non-Dom submission (TD38)

- Housing help: support in finding an apartment or house

- Perfect for founders: combines company formation with the 17-year Non-Dom advantage

Non-EU citizens

Additional steps and residence permits may be required. Check your visa eligibility.

Annual Accounting & Audit Package

Every company in Cyprus is required to maintain accounts and submit audited financial statements. To keep this transparent, we offer a very affordable Accounting & Audit package that will save you a small fortune in the long run.

Tax Administration & Audit (Basic)

- Ongoing booking, tax administration, and audit

- Includes submissions: VAT, VIES, income tax, employer returns, defense contribution, social insurance, HE32

- Covers up to: €100,000 revenue, 100 invoices, 200 bank transactions, two bank accounts, one intangible asset, one employee, one loan position

We offer modular upgrades as your business grows. You can quickly estimate your costs with our accounting cost calculator.

With Cypruslimited.com you get a fully EU-compliant Cyprus company plus affordable annual compliance, free consultation, registration managed through one digital platform with lifetime access to your documents and reminders for due dates.

FAQ: Cyprus Limited Company

Quick answers to common questions about forming a Cyprus Limited company and ongoing compliance.

Who can order a company formation?

Only natural persons from available countries can order a Cyprus Limited for new customers. Once you have a verified Cyprus Limited in our ecosystem, you can incorporate additional companies on behalf of your Cyprus Limited.

Companies from our ecosystem can be registered as additional shareholders during the start-up process.

Soon, adding existing companies to our ecosystem will also be possible.

Where is Cypruslimited.com available?

Our standardized company formation process is currently only available to citizens from the European Economic Area (EEA), the UK, Switzerland, Australia, New Zealand, Canada, and the United States of America.

For other countries, stricter regulations and requirements may be incompatible with our structured process and straightforward pricing.

Immigration/Non-Dom PackageThe Immigration and Non-Dom Package pricing is exclusively for EU citizens.

For non-EU citizens, the workload is significantly higher when applying for a residence permit. Don't hesitate to contact us in advance to check your qualifications and give you a cost estimate.

Is my physical presence needed at any time?

Cypruslimited.com has been designed to meet the needs of digital natives.

So, no, you do not have to be in Cyprus to start and manage a business there. However, a short video call with your assigned tax advisor is required during the Know Your Customer process.

We only need your physical presence during your optional immigration, for example, for the Non-Dom package.

What languages do you support?

The Cypruslimited.com backend and the communication with your tax advisor are in English. From our point of view, you must speak English (except if you speak Greek) to be active in Cyprus and our community.

If you do not speak English, you will be constantly dependent on the help of others. That does not correspond to our concept, target audience, and straightforward pricing.

Nevertheless, once you are in, you are part of our international community of entrepreneurs, and we help and support each other. Also, in your language if required.

Which is the correct formation package for my needs?

Suppose you are here to strive for financial and personal freedom; we highly recommend relocating and taking advantage of the Cyprus Non-Dom program. This way, you can avoid possible double taxation on your worldwide income.

In all other cases, you may want to set up a Cyprus Limited with which you can do business.

How long do you need to confirm a purchase?

Purchases by credit card are confirmed immediately after successful payment processing.

For purchases by invoice, we must wait for the incoming payment to confirm your order. During that time, you can already go through the KYC process and get to know your tax advisor in a personal video call.

Once your payment is confirmed and you finished the Know Your Customer process, you can start setting up your Cyprus Limited immediately.

How does onboarding work?

Onboarding / KYC is a mandatory procedure for tax advisors by the Cypriot authorities. To make the process smooth, fast, and inexpensive, we have created a beautiful online application, especially for this purpose.

Our onboarding is a step-by-step process in which you provide and upload all the requested information and documents. Finally, choose an available video call appointment with your personal tax advisor to get to know each other.

On average, a review takes less than 60 minutes to complete, but it also depends on your personal tax advisor's office hours.

After your introductory video call, you are a verified customer and can begin the company's setup process.

Why Register your Cyprus Company with Cypruslimited.com?

At Cypruslimited.com, we bring together accredited tax consultants, legal experts, and digital-first tools to make your Cyprus setup seamless, transparent, and future-proof.

What Sets Us Apart

- Trusted expertise: We partnered with accredited tax consultants, auditors and legal professionals with years of experience in cross-border structuring.

- Transparent pricing: Flat fees, no surprises. You always know what your setup and yearly compliance will cost.

- Digital convenience: Plan everything with our calculators, guides, and comparison tools. Track your applications online with lifetime access to your certificates.

- Global perspective: We work with freelancers, e-commerce founders, digital nomads, and investors from across Europe and beyond.

Whether your goal is to cut your tax burden, scale internationally, or relocate for a better lifestyle, the benefits of a Cyprus Limited Company make the process worthwhile.

With the right partner, registering your Cyprus Limited Company isn't complicated; it's the first step to unlocking financial security, lower taxes, and the freedom to grow your business globally.